Disclaimer: Stock market investments are subject to market risk, please invest at your own risk.

I am a full-time IT enthusiast with the hobby to make money through the stock market. I was investing for the past 10+ years however mostly based on “expert advice” and very little based on my own research.

Lately, I started making consistent profits from equity trading using a particular theory derived by my cousin. I validated this theory for quite some time first in dummy mode, then with a small investment, and then full-blown and I can tell you from my experience that I NEVER made even a single paisa loss, EVER. It was interesting for me to see the theory work since usually advice from so-called experts often fail and they give strong technical reason to justify failures (who wants to hear excuses when you make losses following their theory).

I then conducted a session for few close friends and some of them also validated this theory and I loved to see that they also started making money through this theory.

What I particularly liked about it that it is simple, easy and quick to understand and follow it and best part is, you only need 10-15 mins at max per day to make profit that too usually after market hours.

Based on popular demand, I am documenting the “Golden Rule” (as I call it) so that people who have not understood it earlier may also understand it and can kep referring to it as and when required.

Pre-requisites

- You need to open a free account in https://in.tradingview.com

- You need a free account in https://chartink.com

- You need a Demat account (I use Zerodha and will use terminology from the same). Why I chose Zerodha? See this video to understand. You may use any Demat account that you have.

What is the concept behind making quick money

Concept is simple: Supply and demand rule

If more people are buying or willing to buy a particular share then it means that its demand is high and its price may go up.

If people are selling or willing to sell a particular share then it means its demand is going low and its price may fall down.

People who push stock price to go high are called Bulls and when somebody says Market is bullish, it means it is going higher.

People who pull stock price down are called Bears and when somebody says Market us bearish, they mean it is going down.

The key is to identify which company’s stock demand is going down and when to buy its stock. Please note that selling is not the key since you may sell at even 0.5% profit or 1% profit (that is what I usually do). Dont be too greedy and you can sell quickly and buy another share and keep repeating it to make profits. Buy at low price and sell at high is the simple formula here.

Here the key is to identify when to buy share of a company or basically when the demand is so low that price is good enough to buy. For that we will setup your Console/dashboard on Trading View.

Setting up Console on TradingView

Login to your in.tradingview.com account and follow the screenshots below to setup:

1: You will get following screen upon your login

2. Now click on any company’s name in the right side (under Watchlist)

3. You will see following screen, now click on fx indicator button

4. Now type EMA RSI here in search bar and click on it when it shows up in the list

5. Now type MACD in the same search box and click on MACD from the list

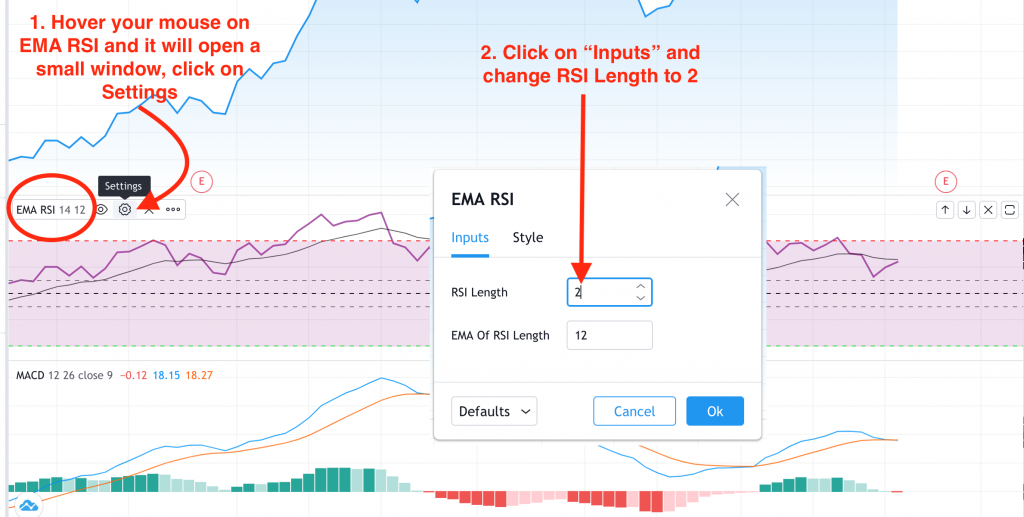

6. Now click on EMA RSI as shown in the screenshot below and change the RSI length to 2

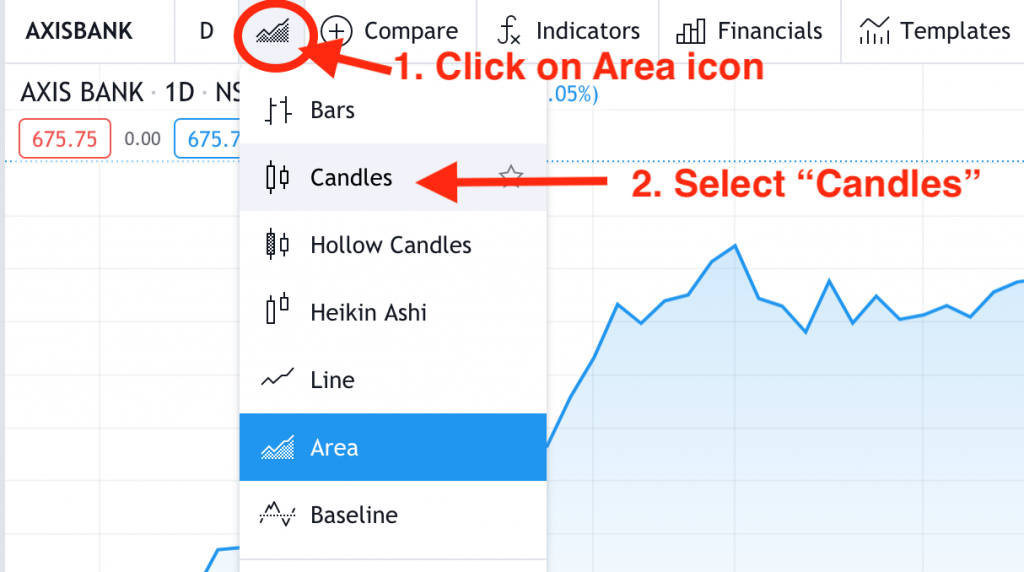

7. Now click on “Area” icon and change it to “Candles”

8. Now your Console setup is complete and it will look like the screen given below

Now let us understand the “Golden Rule”

The Golden Rule

If the demand (EMA RSI) of a stock is less than 10 and MACD has at least one bar in green color, it may be the best time to buy it.

Why?

When EMA RSI is so low that it went down to be around 10 it means that demand of that particular share is very low which also means that the price has fallen for the same. The fundamental key to make profit is to buy a share when the price is so low and sell it when it goes even slightly up.

Ok, so why should I care about MACD bar being green.

Good question, the answer is that when a share price is falling (EMA RSI <10) then nobody knows where will it stop on its downfall however it is guaranteed that every single share (rare exceptions are always there) bounces back and when it bounces back (EMA RSI >30 or >50 or > 90) then the price of the share will also bounce back. So If you buy the share when the price is falling down then you may have to wait for long time for it bounce back however if you buy when it just starts bouncing back then you can make quick money (My definition of quick money is if you make profit within 5 days). That is why I usually follow the Golden Rule of EMA RSI <10 and MACD being at least one bar green.

I also take risk of buying few stocks when EMA RSI <10 and the company is good, stable and large enough to tell me that it is not sinking. In that case I sometimes invest even if MACD is not green however please note that in such cases risk is bigger, wait time for bounce back is bigger, so watchout.

Also one important point is that as we all know that things go bad unannounced so Stock Market is no exception. Take an example of March 2020 when lockdown was announced and entire market came down crashing. The good part is that Golden rule will continue making profit even in such cases since this is a short term game however 20% times, it may happen that a share goes down and takes more than 5 days time to bounce back. So, be ready for such eventualities too. Dont say I didnt tell you earlier 😉

Also another key point is that if you are too greedy and want to make more than 1% using Golden Rule then you may be disappointed. I never made a loss since I am contended with 0.5% or at best 1% profit. Why, because 1% profit daily means roughly 20% profit monthly (Share market works for 22 days every month) therefore 240% profit in an year (20% x 12 = 240).

I would also say, dont trust me and my experience, check the Golden Rule on any company and see if what I am telling is correct or not, validate the formula, test the theory, dont trust blindly.

Now the question is how to search for companies that have so low EMA RSI, that is where ChartInk comes handy. Let us see how to setup Screener/Scan in ChartInk to look for companies that went low on EMA RSI. Please note that ChartInk does not have EMA RSI combination therefore we will look only for RSI value in it and then analyse it using TradingView to find its EMA RSI & MACD values.

Setting up Screener/Scan in ChartInk

Login to your ChartInk account (after you have activated it), and click on the following link

https://chartink.com/screener/golden-rule-vivek-khare

Save this as your own scan

Now click on Run Scan and you will get the list of the companies for which RSI is <10 or 15 or 20 (whatever you define) for that day and MACD is at least one bar green.

Now, pick any company of your choice (I pick up a known brand name) and check its chart in TradingView as shown below. In this example I picked ICICI Lombard.

I would happily place an order to buy it next day at 1452.05 since it went that low and it may again go down to that level tomorrow however it is already at 1494.90 so it may not go down to that level and If I place an order at 1494.90 to buy it and it falls further down then I may have to wait for more than a week’s time (perhaps a month) to make profit. Also MACD is RED which means people may not be interested in this stock and chances are that it will fall. This is the decision that you need to make.

Let us take another example where stock is falling Golden Rule criteria:

Here Wipro has EMA RSI <10 and MACD has many green bars, I would happily buy it at 430.85.

Dont forget to also apply common sense after applying Golden Rule that Wipro is a good company with diverse products so it is not going bankrupt that the price will never bounce back.

How to place automatic order to purchase shares over Zerodha account

Here is the youtube video for the same

So what is next?

Create your own watchlist of stocks

Listen to people giving you TIPS and add those stocks in your console & see if they fall in Golden Rule

Buy 1 share of a company falling in Golden Rule

Sell 1 share and make a profit

Important points:

- Run the ChartInk scan anytime (no need to do it in day time, I usually run it before going to bed) and not necessarily between 09:15am to 03:15pm (this is the time while Stock Market is open)

- Once you analyse a stock to buy, put GTT order to purchase at your preferred price (This also I usually do before going to bed)

- Also put the sell GTT order (1% higher than the purchase price) after putting purchase order (This also I usually do before going to bed)

- Point to note here is that if you are busy in the entire day with your home./office etc, you don’t have to feel bad for not being able to make profit since you are doing all of it off the hours.

- Very important point is that I have not covered other related topics (such as What is EMA, What is RSI, What is EMA RSI, What is MACD, What is GTT . . . . . .blah blah blah) because there is endless knowledge available over Google for you to research and learn. I wanted to keep it as simple as possible so that even those who have never done Stock trading (Buying or selling shares) can understand it and make money.

- There are many theories to make profit and they may also be true but I have not come across any such theories. But i am open to learn, test and follow so if you come to know about any such theories, please dont forget to write to me at kharevivek [at] gmail [dot] com.

- The purpose of this article and the sessions that I have been doing is to make people independent and aware how to make quick money since even your paanwala, doodhwala and akhbarwala can give you TIP as to where to invest money but do you know the logic, the science behind it to see if the tip is really worth. I am happy to see that many housewives/home makers/ young people, first timer in stock market are using this Golden Rule to make profit so I can surely say that it is easy to make money once you understand the concept and start doing small trades.

- I am part of a Telegram group where many people who attended my session discuss this theory, analysis, doubts, questions so if you are interested, write to me over Telegram, my ID is: @kharevivek and I will see if I may get you added to the group.

- Here is the link to the video recording of the session

Happy money making….errr Quick Money Making

Best,

Vivek

Recent Comments